Default servicing refers to the process of managing and resolving mortgage loans that are in default, meaning the borrower has failed to make payments according to the terms of the loan agreement. This process can involve a range of activities, including contacting the borrower, negotiating a payment plan or loan modification, or foreclosing on the property, if necessary. The goal of default servicing is to help borrowers get back on track with their payments and avoid losing their homes, while also minimizing the losses for the lenders or investors who own the loan. Lenders are finding they can mitigate risk and control costs, optimizing their portfolios and keeping more borrowers in their homes, by outsourcing and/or automating default servicing.

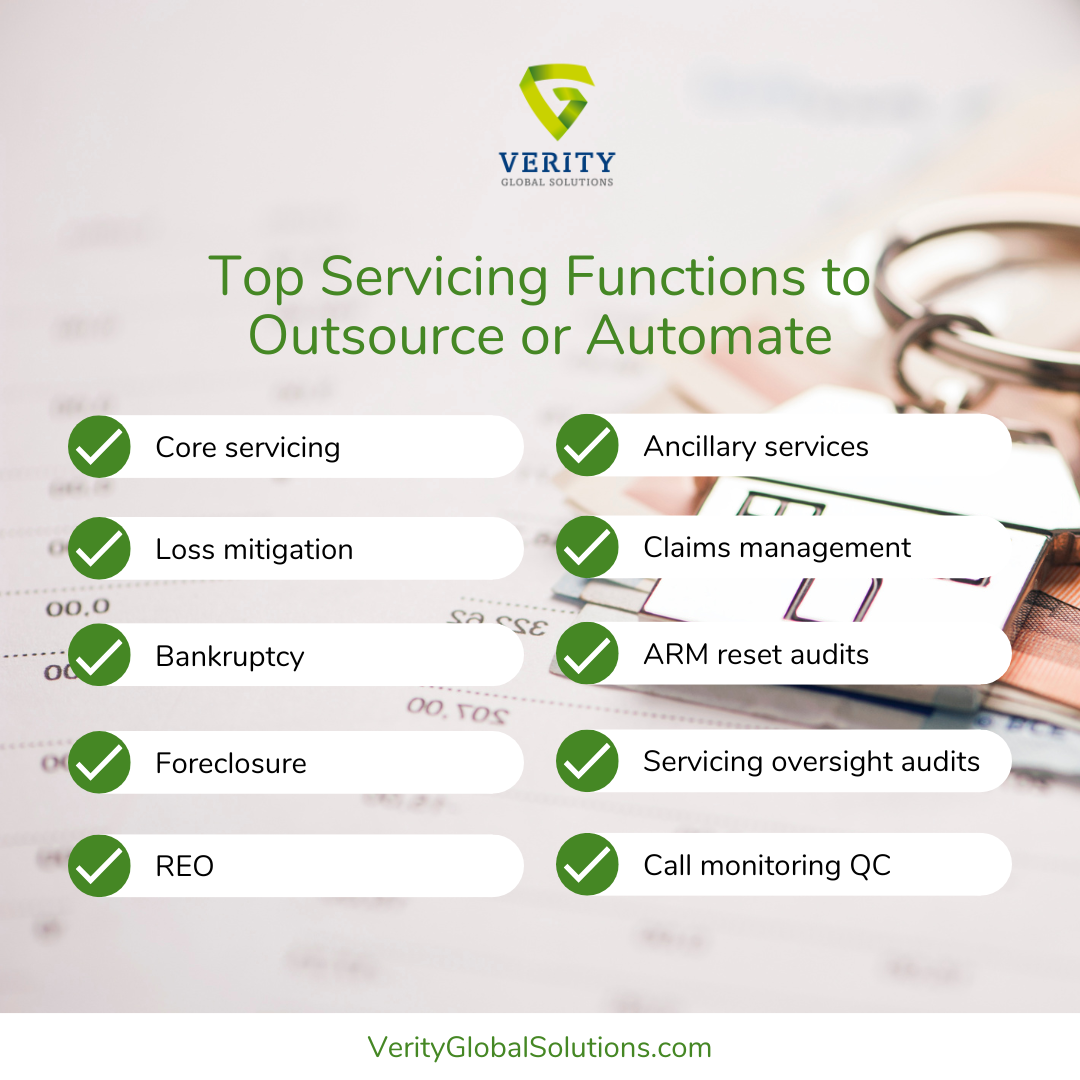

Some finesse is needed here since this can be a sensitive time for borrowers. Lenders find that keeping their high-value employees focused on high-value tasks such as maintaining the client relationship will create happier, stickier borrowers in the long run. Managers can funnel less sensitive work to outsourcers, like Verity, to optimize their workforce. As an example, our team at Verity can handle servicing audits, loan boarding, escrow management, investor reporting, bank reconciliation, default management and loan mod underwriting. Let’s drill down on benefits from outsourcing and automation individually.

Outsourcing default servicing can help lenders in several ways:

Cost savings: Outsourcing default servicing can be more cost-effective for lenders compared to managing it in-house. This is because outsourcing companies have economies of scale and can perform these services at a lower cost.

Improved efficiency: Outsourcing companies specialize in default servicing and have the resources and technology to manage the process quickly and efficiently. This can result in faster resolution of defaulted loans, which can reduce the lender's financial exposure and minimize losses.

Compliance: Default servicing involves complying with a complex set of regulations and guidelines, and outsourcing companies are well-versed in these requirements. By outsourcing, lenders can ensure compliance and reduce the risk of legal and regulatory issues.

Focus on core business: By outsourcing default servicing, lenders can focus on their core business activities and allocate more time and resources to growth and expansion.

Overall, outsourcing default servicing can help lenders reduce costs, improve efficiency, ensure compliance, and focus on their core business, leading to improved financial performance and stability.

New automation technologies are just as impactful for lenders looking to optimize their default servicing portfolios. Many lenders are striking a balance between the cost of technology and optimizing their workflow with customizable bots. RPA (“robotic process automation”) enables lenders to automate highly repetitive tasks, freeing up their staff to focus on high value tasks. Our team has become increasingly interested in how these technologies can be applied to the mortgage space, so much so we acquired a technology company that unlocked Verity’s ability to offer modular, customizable, build-your-own bots to our customers on a transaction-based pricing model. Mortgage companies don’t have a huge capex expenditure for dev work; our solution is opex. How it works is our team studies your workflow and then assembles modules to fit your particular needs, automating what makes the most sense operationally. A Top 10 U.S. mortgage lender deployed Verity’s custom RPA solution for fraud detection, enabling them to reduce process time from 24 minutes to 15 seconds, saving them $1mm+ a year and counting as they scale. It took six weeks to develop.

Another area that technology can help with default servicing is with quality control. Call monitoring QC can be handled with pre- and post-close audit technologies, like Verity’s QCWorks. Enabled by a robust automation and client interfacing technology, QCWorks allows lenders to achieve real-time quality control with extensive reporting capability.

Whether outsourcing or automating, new tools can help lenders optimize their default portfolios, mitigate risks, and keep more borrowers in their homes. If you are interested to learn how your team may deploy outsourcing or automation, get in touch with our team here.

-1.png)

-1.png)