Consumer demand is normally a good thing for the industry holding what they want. However, that is not true for the mortgage industry in the summer of 2022. Due to the low inventory of the housing market and other factors, potential home buyers have found it hard to make a match, and more and more are dropping out of the hunt due to rising rates and inflation concerns.

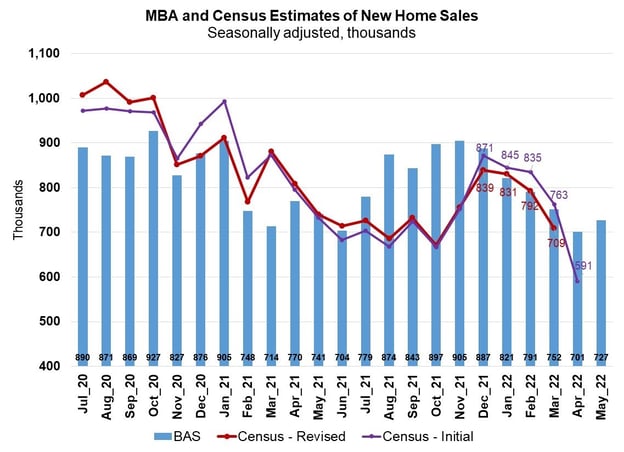

“Applications to purchase new homes in May fell by 4 percent from April, as mortgage rates hit 5.5 percent and further dampened demand. Activity was already constrained due to tight for-sale inventory, high sales prices, and extended building completion timelines,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “After increasing for 15 consecutive months, the average loan size fell slightly from April’s survey high to $430,855, which is a potential indication that cooling demand may be starting to moderate price growth.”

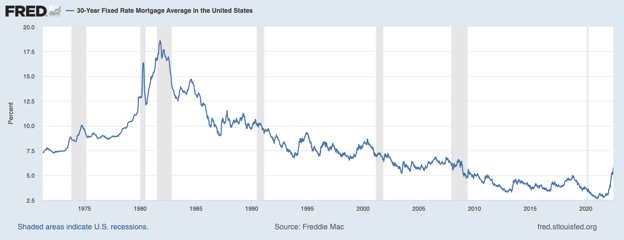

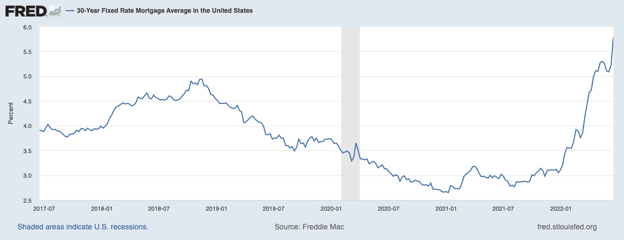

Inflation in May 2022 grew at its fastest rate in 40 years. With the Fed voting to raise its benchmark interest rate by 75 basis points (its biggest hike since 1994) on June 15, 2022, aggressive monetary policy tightening over a longer period of time is more likely. As a result, 30-year fixed rates hit 5.7% June 30, 2022.

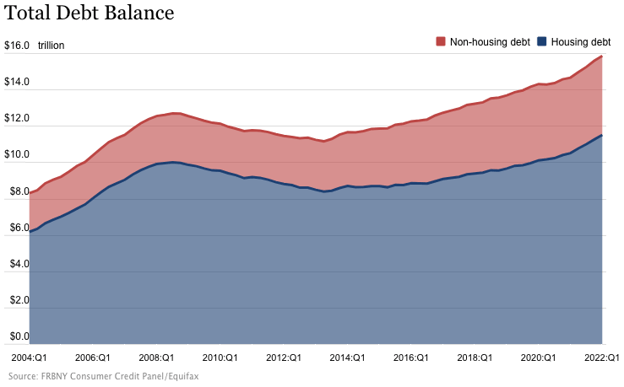

Everyone has their eyes on consumers stressed by rising fuel prices and more and if consumption will slow. Total consumer debt is on the rise.

Note from New York Fed: Mortgage balances shown on consumer credit reports increased by $250 billion during the first quarter of 2022 and stood at $11.18 trillion at the end of March. Balances on home equity lines of credit (HELOC) were relatively flat and have been for the past three quarters, bucking a declining trend in place since 2016Q4; the outstanding HELOC balance stands at $317 billion. Credit card balances declined by $15 billion, a typical seasonal change. Credit card balances had declined significantly in the first year of the pandemic and currently remain $86 billion lower than at the end of 2019. Auto loan balances increased by $11 billion in the first quarter. Student loan balances now stand at $1.59 trillion, and increased by $14 billion in the first quarter of 2022. In total, non-housing balances grew by $17 billion, boosted additionally by a $7 billion increase in other balances, which include consumer finance loans, retail cards, and unclassified loans.

“Further, higher energy prices will weigh on our growth forecast, and we are growing increasingly concerned about signs of a stressed consumer weighing on medium-to-long-term consumption growth, as revolving credit exceeded its pre-pandemic level. As a ratio of aggregate incomes, total debt levels remain below the pre-COVID peak, pointing to further room for consumers to turn to more debt to drive consumption, but the current pace of growth in debt levels is not sustainable, ” Fannie Mae’s Economic and Strategic Research (ESR) Group wrote in its weekly blog.

So where does that leave the mortgage industry? New home sales are down, inflation and rates are on the rise, and consumers’ credit abilities may soon be tapped out. If volumes are down, lenders must turn to other methods to stabilize net margins. Read our next article for three tips on stabilizing net margins.

-1.png)

-2.png)

-1.png)

.png)