An uphill climb faces mortgage industry leaders experiencing whiplash in 2022 as they plan for 2023. You are probably asking yourself these questions when strategizing how you will conquer 2023: Will I need to conduct layoffs? Should I look to M&A with my cash reserves to grow? Is now the best time to invest in technology and automation?

As mortgage companies formulate plans for a successful 2023, consider these four tips:

| 1. | Look at mergers and acquisitions to chart for growth. |

| 2. | Conduct a High Performance Activity calculation to allocate the right labor to the right tasks. |

| 3. | Automate highly repetitive workflows. |

| 4. | Outsourcing to onshore, nearshore, and offshore partners. |

Mergers and Acquisitions

Sales are typically the default tactic deployed by companies looking toward growth, but mergers and acquisitions may be a better way for businesses to grow – especially businesses in the mortgage industry. The mortgage industry is experiencing a unique moment. Coming off of a wildly successful 2020 and 2021, mortgage companies with a strong cash reserve are in a position to acquire competitors or complementary companies that may be struggling. The industry is cyclical and will rebound. So, when it comes roaring back, these companies will be in a stronger position to meet market demands and scale.

Besides merging with or acquiring another company, your team can look at buying another company’s book of business. A company may have opened a vertical that they are no longer interested in operating for whatever reason, leaving an opening for your company to assume the business and expand your revenue.

Labor Allocation – High Performance Activity (HPA) Calculation

When you are planning for 2023, one of the first things you will be considering is your budget. As you are planning your budget, you can lower your salaries and wages line by conducting a HPA calculation. The general idea is to identify if employees are spending any of their time on low-value tasks that do not correspond to their rate of pay. You can most likely get those tasks done elsewhere cheaper.

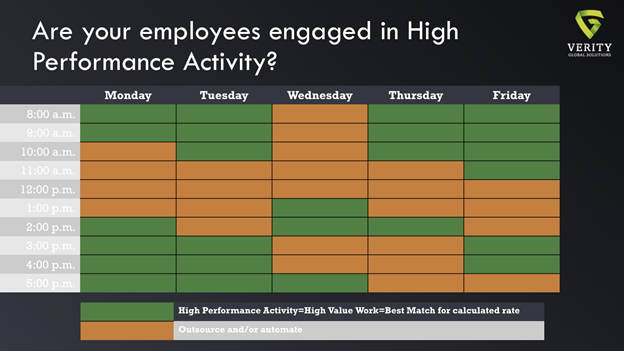

Each member of your team should spend maximum hours in the day producing the highest value work that corresponds with their hourly rate. How do you determine this? Convert your team’s fully loaded annual salaries to an hourly rate, then map that to the work they are doing during the course of the day. You will be able to determine whether the employee you are paying $50 an hour is doing $50-an-hour work. If you look at the chart below, you will see a sample weekly work schedule, with hours in green and hours in orange. Green represents all the hours your workers spend doing the tasks that correspond to their appropriate skills and costs. Orange represents the hours that should be outsourced or automated because they are valued below your employee’s hourly rate. Your goal should be to look at the entire loan process and to produce each piece at the best price with the appropriate labor cost.

Using this model, you’re able to produce every piece of the loan at the right price, giving you the lowest cost of production. With the right partner, knowledge process outsourcing and business process outsourcing can save you 60% for every hour of work they take over from your team.

Using this model, you’re able to produce every piece of the loan at the right price, giving you the lowest cost of production. With the right partner, knowledge process outsourcing and business process outsourcing can save you 60% for every hour of work they take over from your team.

Automation

One important step in your 2023 planning is to fully understand your staff’s workflows and identify any efficiencies that may be on the table. While thinking about your workflows, identify any highly repetitive, manual tasks – those are prime candidates for automation. Automation technology may sound expensive, but it doesn't have to be. Instead of investing in custom development of your own automation, consider automation options that are opex (pay as you go), not capex (large payment up front).

Verity recently studied 200 companies to identify common workflows. We developed a modular automation technology using this knowledge and our combined 200 years in the mortgage industry. We learn your process, link together which modules fit your process, and deploy your own custom, automated bot. You pay as much as you use it. One of our customers recently launched a web scraping bot. It took six weeks to develop, reducing the time it took per loan from 15 minutes to 20 seconds. This customer is saving $1mm a year and growing as the company scales.

In addition to automated bots, you can consider outsourcing your quality control. QCWorks is an automation tool that provides pre- and post-close quality control in real-time. Verity is a third-party reviewer with QCWorks. We perform a number of functions including pre- and post-close QC, servicing QC, call monitoring QC, and servicing oversight. If you are like most lenders, you are 3-4 months behind. A KPO and BPO partner and solution like QCWorks can get you in compliance in under 60 days.

Outsourcing to Onshore, Nearshore and Offshore Partners

After conducting your HPA calculation and identifying what can be automated, you can decide if there are any functions that make sense to hire onshore, nearshore or offshore partners to complete. Not all functions make sense for this solution. Consider the functions that would allow you to scale up and down on demand. Verity has onshore teams that provide contract underwriting and processing. No matter what the market is doing, you can easily turn the lever to meet its demands, not leaving any money on the table.

Our nearshore team provides customer service, executive assistants, sales support and more functions at a fraction of the cost. This team is great to utilize for special projects or for your regular workflow. Our offshore team handles all back office functions for your organization like origination, title and settlement, servicing, Encompass® Help Desk support, Finance and Accounting and QC.

If you decide to outsource onshore, nearshore or offshore, what is most important is that expectations are aligned and that your team fully understands your workflow process.

Contact us at Verity Global Solutions to learn about the leaders in business process outsourcing for the mortgage industry.

-1.png)

-2.png)

-1.png)

.png)